STRUCTURE

Step 2 – STRUCTURE

Finance structure: At Ka-ching Finance, we are dedicated to aiding you in navigating the diverse landscape of mortgage products offered by various lenders. Our team works diligently on your behalf to identify the optimal mortgage loan tailored to your requirements, serving as intermediaries to facilitate the loan securing process.

Based on the strategy session, the specific loan structure will depend on your financial situation, goals, and preferences. However, here’s a general outline of how the loan structure might look based on common considerations:

Loan Type

This could be a fixed-rate home loan, Variable , Principle and Interest or Interest only loan, Full Doc. Low doc , Lease Doc or another type, depending on factors such as your credit score, down payment amount, and financial goals.

Loan Term

The loan term, such as 15 years or 30 years, will be determined based on your preference and financial objectives. Shorter terms typically have higher monthly payments but lower overall interest costs, while longer terms may have lower monthly payments but higher total interest paid over the life of the loan.

Interest Rate

The interest rate will depend on current market conditions, your credit score, and the type of loan. Your mortgage broker will help you secure a competitive interest rate that aligns with your financial goals.

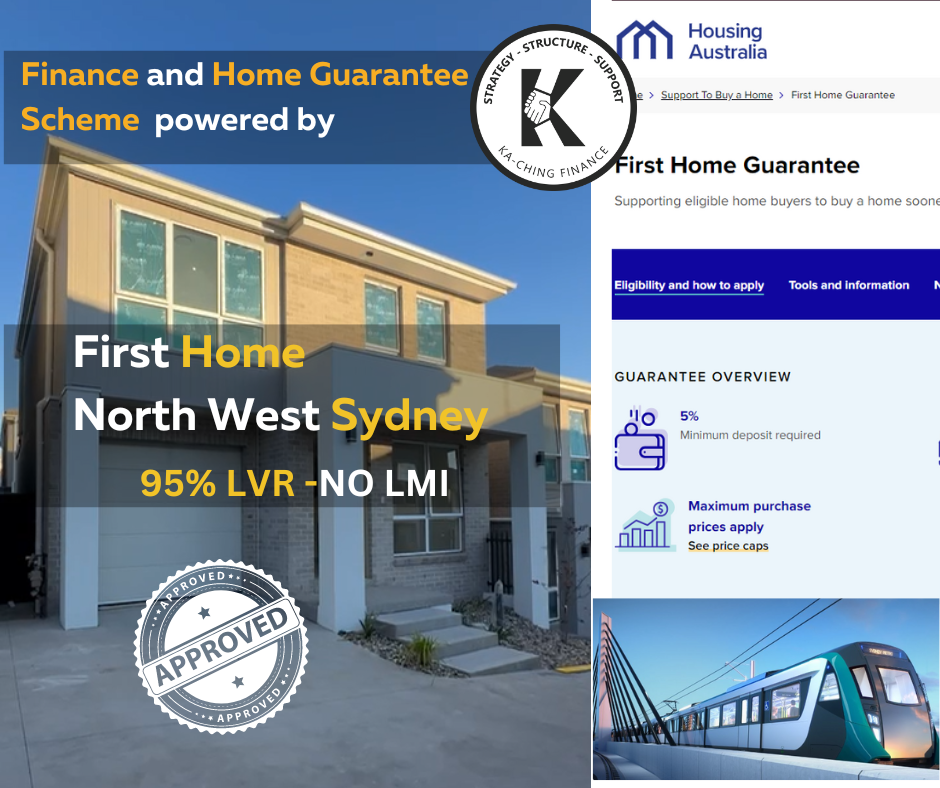

Deposit or Down Payment

The down payment amount will be determined based on the loan type and your financial capacity. Your mortgage broker will guide you on the required down payment and any potential benefits of making a larger down payment.

Pre-Approval

Following the strategy session, you'll move forward with the pre-approval process. This involves submitting necessary documentation to the lender to verify your financial information. Once pre-approved, you'll have a clearer picture of your borrowing capacity.

Funds to complete

We will provide an estimate of closing costs, which may include Lending Mortgage Insurance (LMI), Stamp duty fees, transfer cost, and other expenses. You can discuss whether these costs will be paid upfront or rolled into the loan.

Flexibility and Additional Features

Depending on the lender and loan product, there may be additional features or flexibility. For example, some loans may allow for fortnightly payments or early repayment without penalties.

Timeline and Milestones

We will outline the timeline for the loan process, including milestones such as the Pre-approval process, Unconditional Approval and Settlement.

Remember, the specifics of your loan structure will be tailored to your unique circumstances, so it’s important to maintain open communication with your mortgage broker throughout the process.

Be sure to ask any remaining questions and seek clarification on any aspects of the loan structure that you may not fully understand.

Who is Ka-ching

At Ka-ching Finance, we recognise that for many clients, it's not just about getting the loan.

We provide an end-to-end solution for clients who want to start or grow their property portfolio. How?

STRATEGY

Strategy is absolutely essential to the home buying process. We understand that starting a property journey can be overwhelming, which is why we offer a personalised approach, by working with you to identify your financial situation, goals, and preferences to develop a mortgage strategy that suits your needs.

STRUCTURE

We are dedicated to aiding you in navigating the diverse landscape of mortgage products offered by various lenders. Our team works diligently on your behalf to identify the optimal mortgage loan tailored to your requirements, serving as intermediaries to facilitate the loan securing process.

SUPPORT

We utilise the latest research, data and insights to provide total due diligence on properties you're looking to purchase. At Ka-ching, Finance we're more than your typical mortgage broker. From finding the property, financing the purchase and securing your investment success for the long term - we're by your side.